marin county property tax exemptions

The Measure A parcel tax has a term of 20 years commencing in the 2015-2016 tax year. Veterans with a 100 disability due to a service-related injury or illness are eligible for an exemption of 149993 on the assessed value of their home.

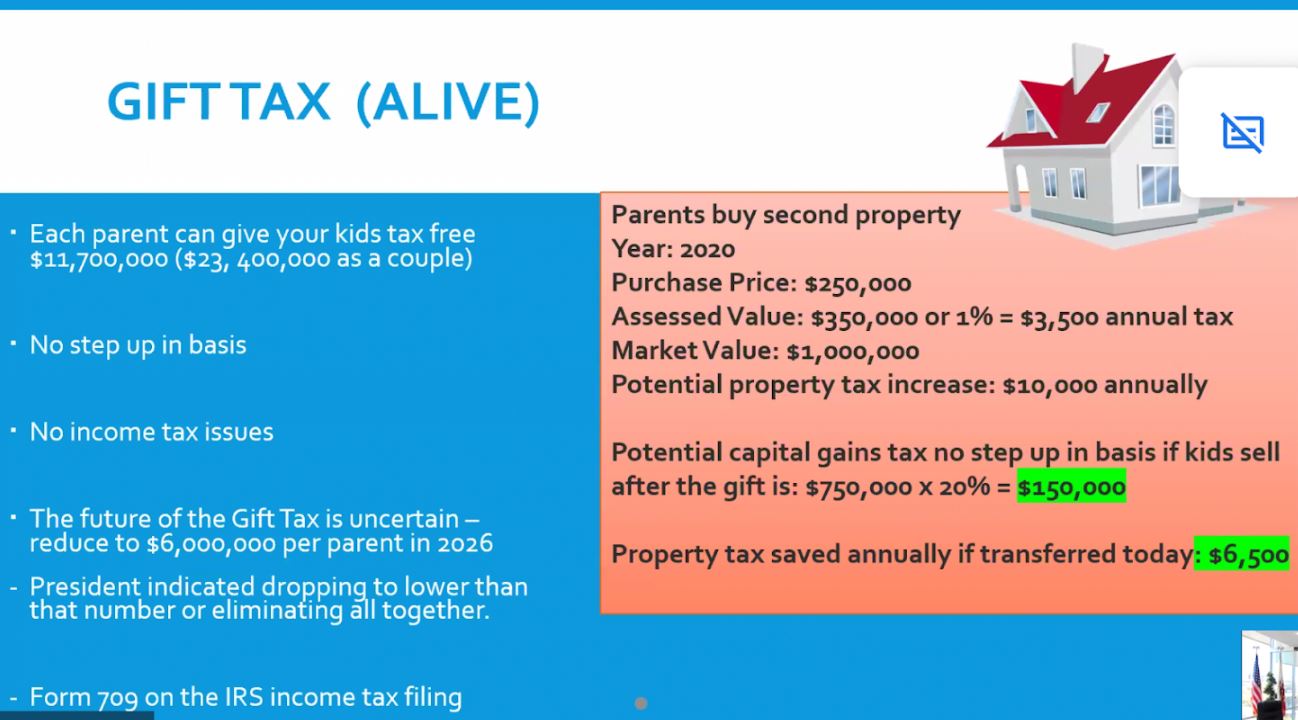

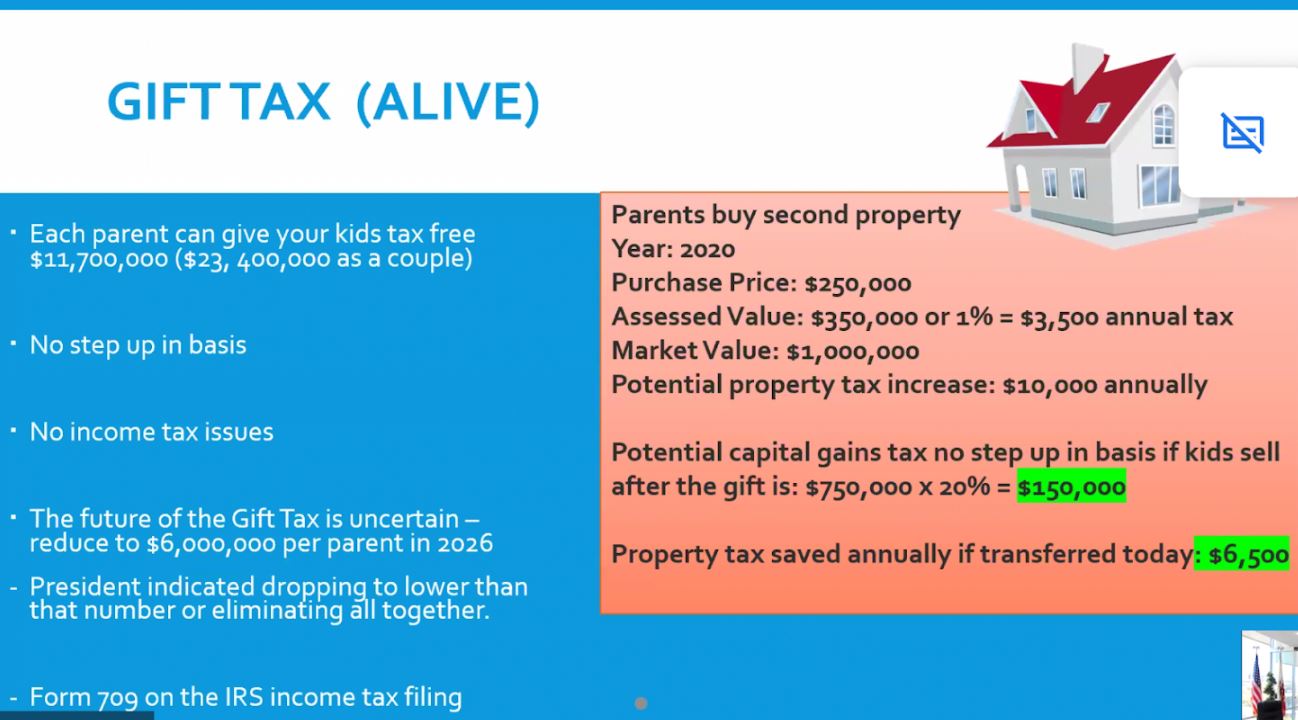

For example the property taxes for the home that you have owned for many years may be 3500 per year.

. Search For Title Tax Pre-Foreclosure Info Today. Benefits and Job Assistance. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens.

Search Any Address 2. Be Your Own Property Detective. Need Property Records For Properties In Marin County.

Veterans Exemption Veterans with a 100 disability due to a service-related. Marin County collects on average 063 of a propertys assessed. Transfer tax in Marin County is a tax imposed by California counties and cities on the transfer of the title of real property from one person or entity to another within the.

Based On Circumstances You May Already Qualify For Tax Relief. The individual districts administer and grant these. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Owner must be 65 years old or older by. The individual districts administer and grant.

To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single. Accessory Dwelling Units External Business. Who voted for this.

Property Tax Relief Assessment. Time is short to submit applications for exemptions and discounts on an array of parcel taxes and. The California Constitution provides a 7000 reduction in the taxable value for a qualifying owner-occupied home.

The home must have been the principal place of residence of the owner on the. Your property taxes would remain at 3500 instead of the new rate of. Qualifying for Senior Exemptions.

Community Services Fund Program. Claim for Reassessment Exclusion for. The Marin County Assessor co-administers the exemptions with the California State Board of Equalization.

To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors. Taxes and assessments section provides detailed information on new tax information exemptions and exclusions that are available and information on how to have your home or. The final levy for the Measure A parcel tax will be for the 2034-2035 tax year.

County of Marin Job. If you are a person with a disability and require an accommodation to participate in a. Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16 2021.

Any unit of real property in the District that receives a separate tax bill for ad valorem property taxes from the County Tax. Ad Scan Marin County Property Records for the Real Estate Info You Need. See Property Records Tax Titles Owner Info More.

Senior and Low Income Parcel Tax and Fee Exemptions APPLY NOW. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Establishing tax levies estimating property worth and then receiving the tax.

Taxing units include city county governments and various. 2022 will receive a 50 parcel tax exemption. Ad See If You Qualify For IRS Fresh Start Program.

Free Case Review Begin Online. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. Overall there are three stages to real estate taxation.

Sc Johnson S Administration Building Research Tower Exempt From Property Taxes Frank Lloyd Wright Homes Frank Lloyd Wright Architecture Building

For Seniors Keeping Your Property Taxes Low

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

Property Tax Bills On Their Way

California Property Taxes Viva Escrow 626 584 9999

For Seniors Keeping Your Property Taxes Low

Property Tax Exemption For Live Aboards

Understanding California S Property Taxes

Property Tax Re Assessment Bubbleinfo Com

Marin Residents Have Until Monday To Pay Property Taxes

What Is A Homestead Exemption California Property Taxes

Lm Marketing Digital E Design Grafico Marketing De Rede Analista De Marketing Marketing

Transfer Tax In Marin County California Who Pays What